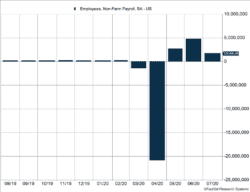

The U.S. economy added 1.8 million jobs in July as hiring momentum in the service sector allowed many workers to reclaim lost jobs or get new ones. The pace of hiring slowed compared to gains of 2.7 million and 4.8 million in May and June. The slowing growth reflects consumer caution as new virus cases surge and the slowing pace of economic reopening.

Key Points for the Week

- Payrolls indicated 1.8 million jobs were added or reclaimed in July, beating expectations of 1.5 million and reducing fears job growth would turn negative.

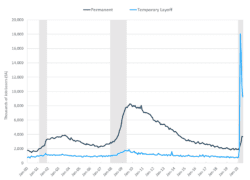

- Permanent job losses remained static, and temporary layoffs shrank to 56% as the service sector hired 1.4 million workers.

- The S&P 500 rallied 2.5% last week, and the index of large-cap stocks neared the all-time high set in February.

As shown in Figure 1, the number of people classifying themselves as permanently unemployed remained steady last month while more than 9 million people continued to see themselves as temporarily unemployed. Those permanently unemployed do not expect to be rehired into the company that laid them off, while the temporarily unemployed do expect to return to a previously held position.

Stocks continued to rally. The S&P 500 surged 2.5%, raising its year-to-date gain to 4.9% and leaving it 0.14% short of the all-time high reached in mid-February. The MSCI ACWI gained 2.1% and is now positive for the year. The Bloomberg BarCap Aggregate Bond Index climbed 0.1%.

Congress and the Trump administration were expected to reach an agreement on additional economic support this week, but those negotiations stalled over the weekend. The failure to reach an agreement will likely pressure markets as certain key industries need support and extra unemployment benefits have expired while many continue to face economic challenges. Retail sales and industrial production from the U.S. and China will likely be the most influential economic data out this week.

Figure 1

I’m Leaving for Work!

The U.S. economy added 1.8 million jobs last month, beating expectations of 1.5 million. The gains were lower than in previous months. June produced 4.8 million new jobs, but those were added when new virus cases were declining. This survey was done the third week of July when new COVID-19 cases were increasing and approaching nearly 75,000 per day.

High-frequency data had raised the risk that the economy may have shed jobs in July. Initial unemployment claims had ticked higher and other employment-related data had weakened. These concerns made adding 1.8 million jobs and beating expectations very welcome news.

Job improvement reflected healthy rehiring momentum in several industries. The service sector added 1.4 million jobs while the goods sector was barely positive. Government payrolls increased by 300,000 last month.

Many unemployed people continue to view their status as temporary. As Figure 2 shows, the number of temporarily unemployed dipped 1.3 million, and those who see themselves as permanently unemployed held steady. The steadying count of those seeing their unemployment as permanent provides a sign people remain hopeful and aren’t likely to step back spending significantly. The level of optimism remained strong despite 49% of the unemployed being out of work for more than 15 weeks.

Figure 2

Congress and the Trump administration didn’t do much to support workers’ confidence last week. The two sides remain unwilling to wrap up negotiations. This prompted the administration to issue several executive orders to support the economy. The constitutionality of the move is questionable but may push the parties back to the negotiating table. We still expect a deal between Congress and the administration will be reached this week, though the odds of failure have increased in recent days.

There are still plenty of workers in need of support. Unemployment is at 10.2%. The service sector today employs 10.5 million fewer workers than in February. The goods sector has made up about half of its losses. Those still hoping to be brought back and those looking for positions after their jobs were lost still total 10.2% of the workforce. Self-employed workers continue to struggle, and more than 650,000 received government benefits in July. Others would like to work but aren’t actively looking for a position.

Our view is the U.S. economy improved some based on the employment data. The strength of July’s report gives us optimism the trend toward recovery will continue. Our optimism is balanced by the slowing rate of improvement, which prompts us to believe the sharpest part of the recovery is over.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.cnbc.com/2020/08/07/jobs-report-july-2020.html

https://www.bls.gov/news.release/empsit.toc.htm

Compliance Case: 00799377