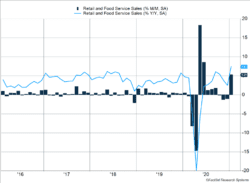

American consumers put their stimulus checks to work last month. Retail and food service sales rose 5.3% in January, after declining 1.0% in December (Figure 1). Compared to one year ago, sales are 7.4% higher. The strong data resulted from the stimulus checks and declining virus cases. Because of restrictions and risk, the biggest winners were online retailers. Home improvement stores also experienced strong demand as consumers continue to spend extra time at home.

Key Points for the Week

- Retail sales rose 5.3% as stimulus checks fueled a spending boom.

- Residential housing starts slowed in all regions as the cost of lumber has slowed down a strong housing market.

- Stocks and bonds both fell as interest rate increases are pressuring both asset classes.

Industrial production also rose last month. January’s 0.9% follows an upwardly revised 1.3% increase in December. Housing starts dipped 12.2% in January while remaining 17.5% above last January. Low interest rates continue to make housing affordable at the same time as increasing lumber prices have started to weigh on demand.

The trend toward stronger economic growth has started to push interest rates higher. Because bond prices move inversely with interest rates, the Bloomberg BarCap Aggregate Bond Index declined 0.6% last week and is 1.8% lower this year. Higher yields provide more competition for stocks and increasing rates can sometimes pressure stock returns. Last week, the S&P 500 dropped 0.7% in response to higher rates. The MSCI ACWI index dipped 0.3%.

How the economic trends affect interest rate expectations will likely affect markets in coming weeks. Next week, personal income and personal spending data will shape our understanding of how individuals are faring. Some Asian economies will also provide industrial production data that may confirm the beginning of a broad-based industrial recovery.

Figure 1

I’ve Got Money to Burn

Some say economics is a complicated subject, with its formulas and graphs. Last week’s economic lesson wasn’t that complicated. As one economist noted, “If you give the American consumer free money, they will spend it.”

That spending led to a very encouraging report on U.S. retail and food service sales. Sales increased by a seasonally adjusted 5.3% in January, compared to a decrease of -1.0% in December. The report also noted that sales were up 7.4% year-over-year which, when adjusted for inflation, was the largest year-over-year increase since June 2005 (Figure 1).

One of the main reasons cited for the sharp increase in spending is the $600 stimulus checks sent to most Americans. It appears the stimulus helped Americans buy more and go out to restaurants more than they otherwise would have in January. We are expecting further fiscal stimulus to pass over the next several weeks, which will most likely include additional checks to Americans. This should lead to further increases in consumer spending in the coming months.

Another major factor leading to increased spending is the vaccine rollout. Vaccine distribution in the U.S. has been rising steadily from an average of 326,000 per day at the beginning of January to more than 1.5 million per day on January 31. As more Americans get their first vaccine shots and, more importantly, their second, we can expect to see consumer behavior return to normal as people become more comfortable leaving their homes. The increase in vaccinations is also allowing state and local restrictions to ease up as infections slow. As of last week, 33 states were easing or had completely lifted restrictions, while 12 were tightening restrictions or had paused reopening. If the reopening trend continues, which we expect it will, we can expect consumer behavior to return to normal levels.

Regarding where the money has been spent, the theme of creating a cozier home environment continued, as the two largest increases were in electronics and appliance stores (14.7%) and in furniture and home furnishings (12%). And while building materials, garden equipment and supply stores (think home improvement) only saw an increase of 4.6% on the month, year-over-year it is up 19%. Another trend we observed was the continued increase in online sales, which rose another 11% for the month and is now up almost 29% since last year — a transformation in U.S. consumer behavior we expect will continue.

Last week’s retail spending report was a very important sign and step in the right direction for an economy that derives more than two-thirds of its activity from consumer spending. It was especially important given the decrease in December. What we will continue to look out for is whether another round of stimulus payments will be distributed in March and what effect they may have. Odds are a lot of that money will get spent.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://fred.stlouisfed.org/series/PCEPILFE

https://fred.stlouisfed.org/series/DGS10

https://fred.stlouisfed.org/series/T5YIE

https://www.cnbc.com/2018/10/26/when-tracking-inflation-the-fed-thinks-this-index-is-better.html

FactSet: Earnings Season Update February 2021

Compliance Case #00960199