The lack of progress on a federal stimulus bill weighed on markets last week while economic and earnings data provided investors some good news. Initial unemployment claims finally dipped below 800,000. The improvement and adjustments to previous weeks’ estimates suggest the labor market is continuing to recover. Corporate earnings also provided a positive surprise. While many companies are still to report, initial results show 84% of S&P 500 companies are beating estimates.

Key Points for the Week

- Initial unemployment claims finally dipped below 800,000 as the labor market continues its slow recovery.

- U.S. corporations are beating earnings expectations frequently and by wide margins.

- The Chinese economy continues to bounce back on the strength of industrial activity and better control of the coronavirus.

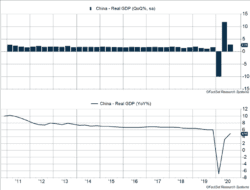

Two areas that are bouncing back quickly are China and housing. The Chinese economy grew 2.7% last quarter and will likely be the only major economy to grow in 2020. (See Figure 1.) The Chinese continue to emphasize exports, real estate, and infrastructure over the consumer. Industrial production rose 6.9% and retail sales only grew 3.3%. U.S. housing data point to a robust recovery. Single-family home sales rose 8.5% and existing home sales also beat expectations.

Many stock market investors remain fixated on the need for more stimulus. That creates a scenario where good news is “bad news” as it may reduce the urgency to pass a stimulus package. The S&P 500 gave back 0.5% last week. The MSCI ACWI index dipped 0.2%. The Bloomberg BarCap U.S. Aggregate Bond Index dropped 0.4% as interest rates moved slightly higher.

U.S. GDP will headline this week’s economic reports. Consensus estimates are for growth to approach 30% (annualized) and regain much of the economic activity lost in the second quarter. COVID-19 is also expanding in the U.S. and Europe and data on new cases and hospitalizations will be followed closely to gauge whether additional social distancing measures will be required. Durable goods data and eurozone GDP may provide additional clarity to the speed of the economic recovery.

Figure 1

Bouncing Back

The Chinese economy is bouncing back from COVID-19 challenges. As the first country to get the virus, China has also been one of the first to recover. Its economic recovery highlights many of the key themes that will influence the global economic recovery. Below are some important lessons we are learning from the Chinese recovery:

- Growth snaps back and then slows: Chinese GDP grew 2.7% last quarter after a bounce back of 11.7% in the second quarter. (See Figure 1.) The U.S. economy is expected to show approximately 30% growth in the third quarter, but that number is annualized. If U.S. growth is adjusted, it would be closer to 6%. After this quarter, growth in the U.S. is also expected to slow as segments unable to open are restraining the return to a healthier economy.

- Virus control allows growth activity to resume: China is reporting a very small number of new COVID-19 cases. Strong testing and draconian restrictions allowed the Chinese to get control of the virus more rapidly. Even discounting the accuracy of Chinese data, China’s situation has improved more quickly than the rest of the world. Once virus cases dropped to low levels, economic activity was slowly allowed to resume. A more severe decline in the first quarter allowed a sharper rebound in the second quarter. China is the only major economic region expected to grow in 2020.

- China tries to invest its way out of problems: Real estate investment grew 5.6% and high-tech industries climbed 9.1%. Much of the boost comes from the government as private sector investment dropped 1.5%. The Chinese playbook during a downturn is to build more factories and homes to fuel growth.

- Manufacturing and exports remain key: Once investment is made in an industry, the goal is to begin exporting to others. This policy of relying on economic growth outside of China to fuel internal growth means China isn’t contributing enough to a global economic recovery. Industrial production accelerated last quarter to 5.8% growth. Retail sales only edged up 3.3% and have not fully recovered. Industrial production is back to previous levels.

The Chinese recovery provides several guideposts for the U.S. economy. Our expectation remains the U.S. recovery will continue to be slow and steady. For the services sector, gains will be difficult without continued medical advances. The lower death rates during the recent surges offer an indication of improved care. Additional gains will be necessary to increase activity in key leisure sectors, such as dining and travel.

The U.S. focuses more on consumers than industries. Both major U.S. political parties prefer to give out aid directly to individuals. Additional support for damaged industries could benefit U.S. suppliers and support an overall recovery.

The U.S. focus on consumers results not only in checks being sent to individuals but higher unemployment benefits. U.S. consumers turn around and spend much of that money. The spending helps retailers. It also helps China as many of the goods purchased include Chinese components. It turns out U.S. support packages are a key contributor to the Chinese economic rally.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://insight.factset.com/sp-500-earnings-season-update-october-23-2020

https://www.frbatlanta.org/cqer/research/gdpnow

https://www.worldometers.info/coronavirus/country/china/

Compliance Case: 00891450